Which Of The Following Usually Offers Money Mutual Market Funds?

What are Money Market Funds?

Coin market funds are open-ended fixed income mutual funds that invest in short-term debt securities, such as Treasury bills , municipal bills, and short-term corporate and bank debt instruments that come with low credit adventure and emphasize liquidity.

Understanding Money Market Funds

Money market securities typically come with maturities under 12 months. The short-term nature of the securities is a fashion of reducing risk and doubt. The selection of money market investments is performed past a fund manager as it should relate to the blazon of coin market fund. Coin market funds are not insured by the federal government (FDIC), unlike money market place accounts, which are insured.

Coin market place mutual fund income is ordinarily in the form of a dividend ; it tin can be taxed or revenue enhancement-exempt depending on the nature of securities invested in the fund. The funds can exist used as a cash management tool in business organisation because of their liquidity and flexibility, hence their popularity.

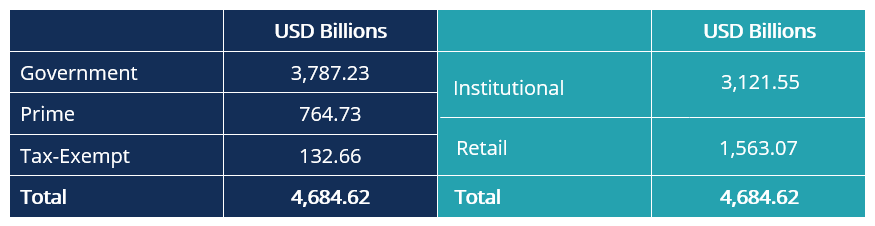

Money marketplace funds were adult and came into use in the 1970s. They are regulated through the Securities and Exchange Commission (SEC) under the Investment Visitor Act of 1940 in the United states and Regulation 2017/1131 in Europe. According to the Investment Company Constitute, coin marketplace funds total $iv.68 trillion, as of June 17, 2020, and are distributed every bit follows:

Objectives of Money Market place Fund Investments

Investors take part in money market place funds for the following reasons:

- Short-term investment horizon

- Low conservative risk ambition with preference to low-security volatility

- Loftier liquidity needs

- Depression returns, which is compensated by low risk

- Stability and certainty

Types of Money Market Funds

The Securities and Commutation Commission (SEC) regulations contain iii categories of money marketplace funds based on the securities in the fund:

1. Authorities

The funds invest in nearly 99.5% in government-backed securities such as U.S. Treasury bills, collateralized U.S. Treasury securities, repurchase agreements, and Federal Home Loan securities. They also invest in regime-sponsored enterprises (GSE) securities, such as Freddie Mac and Fannie Mae. Since authorities-backed paper is "take a chance-free," the funds are considered very safe.

two. Prime

They are funds invested in brusque-term corporate debt instruments, such equally commercial newspaper, corporate notes, and short-term banking company securities (broker's acceptances and certificates of deposits). They too include repurchase and reverse repurchase agreements.

3. Municipal tax-gratuitous

The money marketplace funds are predominantly invested in securities issued by municipalities, which are federal and oft country income taxation-exempt securities. Other entities too issue securities with tax protection, which the money funds also participate in, such equally state municipal.

Benefits of Using Coin Market Funds

one. Liquidity

The redemption of a money market fund usually takes less than two business organisation days, and it is fairly piece of cake to settle brokerage business relationship investment trades.

two. Risk management

Money market funds act equally a gamble direction tool, as funds are invested in cash equivalent securities with low hazard and high liquidity.

three. Short-term

The short-term nature of money market funds ensures a low interest rate, credit, and liquidity risk.

4. Security

Money market funds invest in depression-gamble and high-credit quality securities, ensuring high security.

5. Stability

Coin market funds are low volatility investments.

6. Convenience

Like shooting fish in a barrel access to funds through a checking account linked to an income-yielding money market investment fund.

7. Diversification

Money market funds commonly hold a diversified portfolio of government, corporate, and revenue enhancement-gratuitous debt securities.

viii. Tax exemption

Municipal issues in which money market funds invest in are federal and often state income tax-exempt; hence they provide revenue enhancement-efficient income.

Money Marketplace Fund Risks

ane. Credit run a risk

Money market securities are susceptible to volatility and are not FDIC-insured, hence the potential to not lose money, nevertheless depression, is not guaranteed. There exists a probability of loss, although information technology is by and large quite small. There is no guarantee that investors will receive $ane.00 per share on the redemption of their shares.

2. Low returns

The low returns of money market funds are ordinarily lower than other funds comprising of assets such equally stocks and backdrop. At that place is a take chances that money market returns may besides fall below the aggrandizement charge per unit , providing negative real returns to investors (inflation risk). Involvement rates can also get down further, reducing returns on money market investments.

3. Liquidity fees and redemption gates

It involves the imposition of high liquidity fees, i.e., fees levied on the sale of shares. Redemption gates require waiting periods before redeeming proceeds from money market funds, commonly implemented to prevent a run on the fund in periods of market stress.

iv. Foreign exchange exposure

This adventure is borne by funds that invest in money marketplace instruments across borders that are denominated in other currencies other than the home currency.

5. Environmental changes

Changes in economic policies and government regulations tin can consequence in an adverse touch on the cost of money market place securities and their issuers' fiscal continuing, i.e., if they affect interest rates and money supply.

Related Readings

CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to help anyone get a globe-grade fiscal annotator. To go along advancing your career, the additional resource below volition be useful:

- Credit Take chances

- Federal Eolith Insurance Corporation (FDIC)

- Municipal Bond Credit Assay

- Types of Markets – Dealers, Brokers, Exchanges

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/money-market-funds/

Posted by: reyhithorable.blogspot.com

0 Response to "Which Of The Following Usually Offers Money Mutual Market Funds?"

Post a Comment